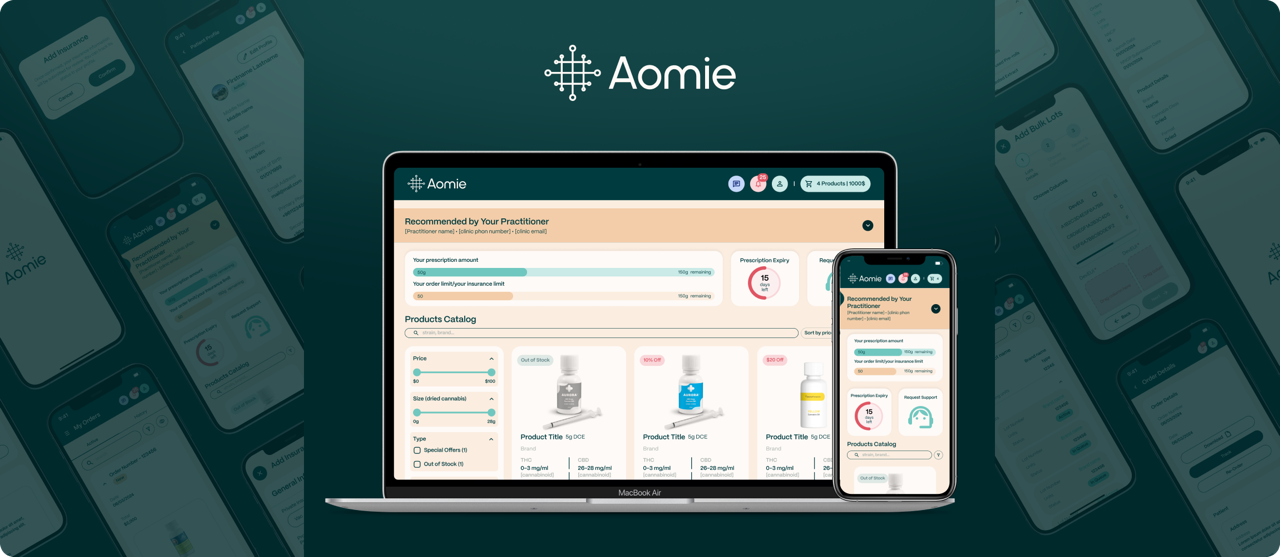

Aomie

Fersan Capital architected and continues to develop Aomie as a Venture Studio partner, delivering a three-portal, multi-tenant platform that provides the regulated marketplace for medical cannabis sales.

-

Total Regulatory Mastery

Built for mandatory adherence to the Canadian Cannabis Act and PIPEDA/PHIPA data residency, ensuring your operation is always protected.

-

Rules-Engine Security

A powerful, centralized engine enforces compliance across all critical flows, managing everything from age-gated user access to complex caregiver permissions.

-

AI-Driven Prescription Processing

Securely routes and processes prescriptions using advanced AI, streamlining the path from doctor to fulfillment.

-

Intelligent Checkout

Dynamically calculates insurance-aware pricing and a precise potency-aware tax model in real-time, eliminating costly manual calculations.

-

Fulfillment Precision

Intelligently splits orders across fulfillment centers based on up-to-the-second lot/batch inventory tracking for maximum efficiency.

-

End-to-End Traceability

All transactions are fully audit-logged, creating a single, traceable system that minimizes risk and simplifies complex regulatory reporting at scale.

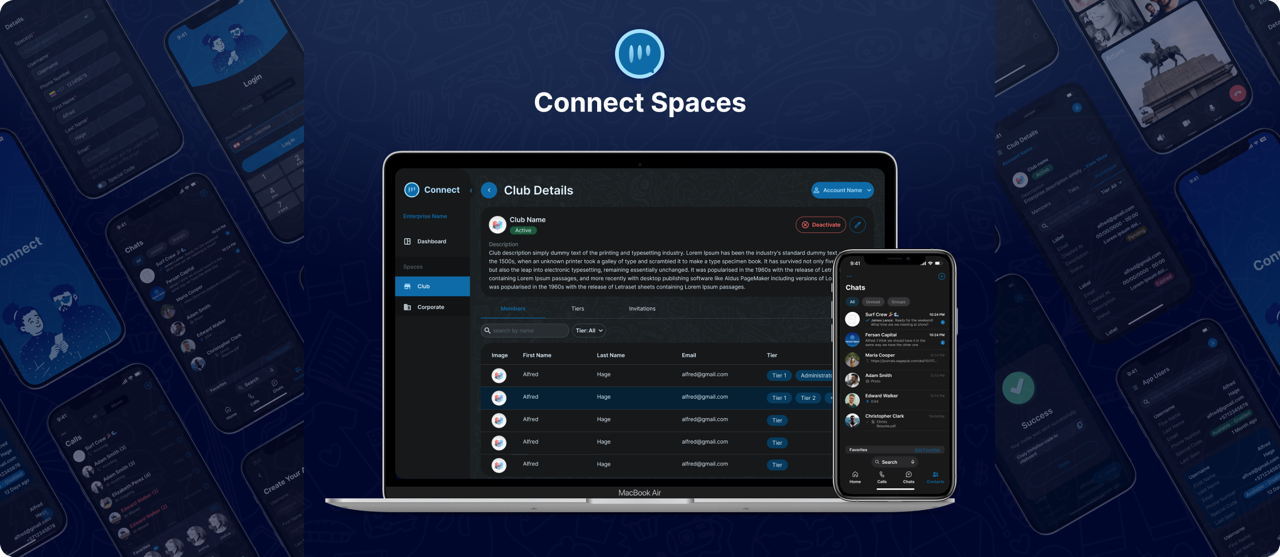

Connect Spaces

As a Venture Studio partner, Fersan Capital architected and continues to scale Connect Spaces, the multi-tenant platform designed to replace siloed tools with a single, governed, and unified solution.

-

Unified Communications Power

Delivers secure chat, voice, and video via a robust WebRTC engine, utilizing native Android, iOS, and Web clients for a frictionless user experience.

-

Consumer Simplicity, Enterprise Control

Masterfully combines the ease-of-use of consumer messaging with the governance and distributed permissions model required by demanding organizations.

-

Security & Data Sovereignty

Supports multi-node roaming and self-hosted nodes, allowing organizations to maintain data residency and control, even while users communicate across public and private spaces.

-

AI-Engineered for Efficiency

Features powerful, context-aware AI directly integrated into the platform for functions like real-time translation and RAG functionality, enhancing collaboration.

-

Protect Sensitive Discussions

Space owners define all access and rules, seamlessly integrating organizational structure to ensure communications—from the most secret to broad customer collaboration—are completely secure and protected.

Carrot

Fersan Capital architected and developed Carrot as a Venture Studio partner, delivering a dynamic social media platform built to reward participation and redefine digital content ownership.

-

Modular Content Revolution (Cards)

Moves beyond simple posts with "Cards," app-like content units capable of hosting complex interactive experiences, commerce features, and rich multimedia—giving creators unlimited flexibility.

-

Creator-First Governance

Empowers Space owners with a distributed permissions model to define custom access controls, including private paywalls, tiered memberships, and sophisticated demographic filters.

-

Adaptive Security & Control

Features a unique governance model that blends algorithmic efficiency with community input, ensuring a balanced and healthy platform ecosystem.

-

Integrated AI Intelligence

A robust suite of AI systems drives intelligent recommendations, sophisticated content moderation, and liveness verification at massive scale, ensuring platform safety and relevance.

-

Tokenized Ownership Economy

Underpinned by a custom-built, self-custodial Carrot Wallet that links participation directly to reward.

-

Instant Web3 Functionality

Enables instant NFT minting directly from user content, in-app reward distribution, and seamless multi-chain bridging and swapping, establishing a truly user-driven, participatory economy.

INFLUENCE by the London Fund

Fersan Capital served as the strategic Tech Lead and Development Partner, providing fractional CTO, Product Management, and Software Development to create a cutting-edge VC-as-a-Service Fund OS.

-

Real-Time Financial Precision

Architected and deployed a complete VC-as-a-Service Fund OS on an event-driven stack, delivering an instantaneous equity ledger for complex financial mechanics.

-

Automated Finance

Provides automated handling for complex distributions, including internal secondaries and instantaneous exit calculations, ensuring speed and accuracy at every stage.

-

Proprietary Growth Module

Integrated The Echo Chamber—a specialized growth accelerator that facilitates high-impact services-for-equity agreements for the portfolio.

-

Investment Thesis in Action

This proprietary system translates investment theses into verified Influencer activations, linking campaign outcomes directly to fund KPIs.

-

Data-Driven Capital Allocation

Ensures capital allocation decisions are directly aligned with live market traction data, maximizing investment impact and minimizing risk.

SLIC

Built for NBA Legend and Entrepreneur Baron Davis, Fersan Capital served as the Tech Lead and Development Partner to create SLIC, a dedicated creator-brand marketplace built for security and high-throughput execution.

-

Governed Campaign Workflow

Built on an operable "guardrail system" that codifies the entire campaign lifecycle, transforming creator marketing into a repeatable acquisition channel with clear SLAs.

-

High-Throughput Automation

Automates every step—from brand brief and creator self-service applications to deliverable verification and rules-based payout—enabling standardized vetting and high-throughput execution at scale.

-

Secure Financial Operations

Ensures financial integrity through policy-driven release criteria, comprehensive audit logs, and dispute minimization, resulting in lower coordination costs and maximum trust.

-

High-Fidelity Media Handling

Engineered with advanced features like resumable, chunked uploads and a human-in-the-loop moderation model for seamless, high-quality media management.

-

Data-Driven Accountability

Integrated measurement pipes stream crucial view and impression data directly into campaign dashboards, providing brands with real-time ROI visibility.

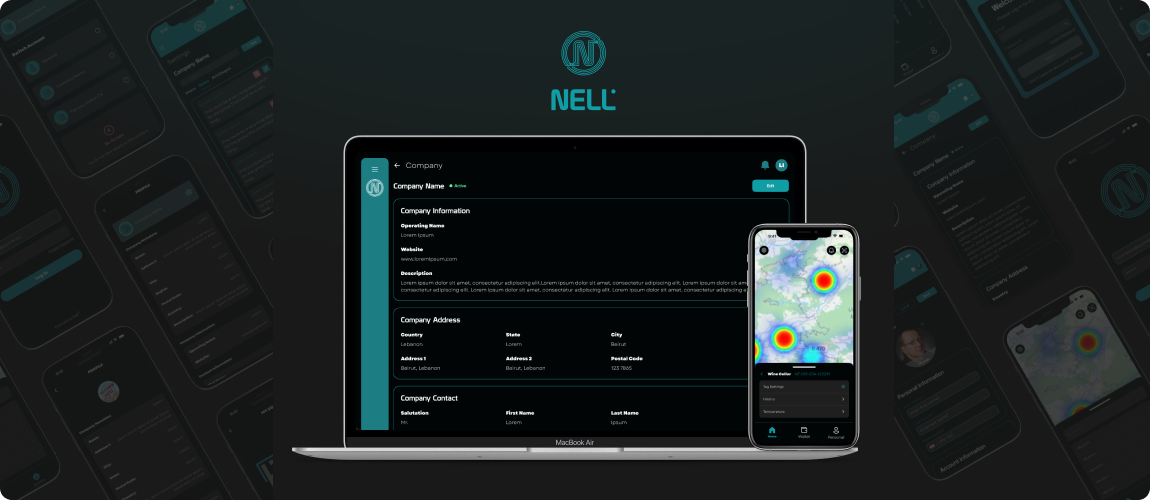

Nell

As a Venture Studio investor and partner, Fersan Capital architected and developed Nell, the unified, Any-Network Ready platform designed to simplify complex IoT deployments at scale.

-

Universal Network Coverage

Manages diverse devices and networks seamlessly across LoRaWAN, BLE, GPS, and Wi-Fi, providing a true single-pane-of-glass solution.

-

Fleet Lifecycle Hub

Features a powerful Network Health Console and Gateway Fleet Manager for frictionless provisioning, monitoring, and reassigning of entire device fleets at scale.

-

High-Volume Data Intelligence

Engineered with a dedicated Time-Series Data Vault for high-volume telemetry and an Event Rules & Automation engine for instant, complex logic and decision-making.

-

Real-World Application Success

The integrated Nell Edge Tag demonstrated platform power through optimized firmware for ultra-long battery life and specialized functions.

-

Advanced Logistics Capabilities

Enables critical use cases like GPS-free Signal-Smart Location and precise Cold-Chain Temp Sensing, ensuring specialized assets are always tracked.

-

Streamlined Monetization

Governed by a flexible, metered Subscription & Entitlements system, simplifying billing and access control for both tenants and individual devices.

Coupond

Fersan Capital architected and developed Coupond as a Venture Studio partner, delivering a revolutionary loyalty platform that bridges physical and digital worlds through AR missions and tokenized real-world assets.

-

Tokenized Real-World Assets

Organizes and tokenizes physical assets (stores, shelves, SKUs, markers, beacons, events) into a governed asset graph, creating digital twins with full traceability and governance capabilities.

-

AR Missions & Interactive Engagement

Features on-pack and in-store AR mini-games that drive customer engagement, creating memorable brand experiences that increase loyalty and repeat purchases.

-

Intelligent Rules Engine

Advanced promotions engine with geo/time/behavior triggers and per-user caps ensures targeted, personalized campaigns while preventing abuse and maximizing ROI.

-

First-Party Data Flywheel

Collects consented 1P data that powers better targeting, measurement, and personalization, creating a sustainable competitive advantage for brands.

-

Fraud Prevention & Security

Comprehensive fraud controls including duplicate detection, device binding, and anomaly flags protect program integrity and prevent losses.

-

Analytics & Compliance

Powerful dashboards and lifecycle messaging combined with GDPR-aligned data residency options ensure both business insights and regulatory compliance.

CryptoMATC

Fersan Capital conceived and architected CryptoMATC as an NFT creation and orchestration engine, evolved to power multi-layer collections with complex logic and gas-efficient lazy minting across multiple chains.

-

Multi-Layer Generative Engine

Configurable layers and traits (backgrounds, characters, accessories, effects, and more) generate infinite valid combinations while guaranteeing uniqueness and respecting visual system each collection.

-

Rules-Driven Rarity & Constraints

Advanced logic with rarity weights, blacklists/whitelists, mutual exclusions, and collection-wide limits ensures each NFT follows the intended design and rarity model—even at large scale.

-

Dynamic Lazy Minting

Art and metadata are prepared off-chain and minted only when purchased or claimed, minimizing upfront gas costs while preserving full on-chain provenance and authenticity.

-

Multichain by Design

Abstracted from any single network, CryptoMATC supports deployment on multiple chains and layers, keeping a consistent creation workflow, metadata schema, and drop logic.

-

Creator & Founder Collaboration

Acts as the technical backbone where artists, technical founders, and vision-led investors collaborate: creators define the art, founders configure the logic, and CryptoMATC handles generation, validation, and mint orchestration.

-

Open Minds Proof of Concept

Demonstrated its power through Open Minds, a 10,000-piece Solana collection focused on mental health awareness, showcasing layered artwork, sophisticated rarity design, and lazy minting powered entirely by CryptoMATC.

BIG

Fersan Capital served as the Tech Lead and Development Partner to build BIG, an invite-only platform that combines secure messaging, curated deal rooms, and premium events to compound access, opportunity, and trust within exclusive networks.

-

Tiered Membership System

Sophisticated membership tiers with role-based entitlements and benefits create clear value hierarchies, encouraging engagement and upgrades while maintaining exclusivity.

-

Premium Events & Networking

Integrated event management with RSVP tracking, automated follow-ups, and attendance analytics transforms online connections into high-value real-world relationships.

-

Curated Deal Rooms

Secure, structured deal rooms facilitate investment diligence and collaboration, enabling members to evaluate opportunities, share insights, and coordinate investments efficiently.

-

Integrated Payment Infrastructure

Seamless payment processing for membership dues, event tickets, and premium perks eliminates friction and ensures smooth financial operations.

-

Operator Intelligence Dashboards

Comprehensive dashboards track retention, engagement, and investment activity, providing operators with actionable insights to optimize community health and growth.

-

Trust & Network Effects

The platform architecture amplifies network effects by making introductions, deal flow, and shared opportunities increasingly valuable as the community grows.